Cryptocurrencies normally have a predetermined supply schedule or a fixed issuance rate encoded into their code. This finite supply creates scarcity, making each unit of the cryptocurrency more valuable as demand increases.

Explanation of supply shock with regard to cryptocurrency

Supply shocks can happen suddenly and are unexpected. It dramatically changes the effects of supply which leads to an unexpected change in the price. These events can be positive or negative which lead to an increase or drop in the supply. For example, the price of a cryptocurrency could shoot up when there is little supply or could shoot down when there is an oversupply, this is all when the demand remains constant.

Understanding the causes of supply shock is essential for investors as it can have a massive impact on people's investment strategy.

Cryptocurrencies normally have a predetermined supply schedule or a fixed issuance rate encoded into their code. Decred, for example, has a capped supply of 21 million coins, with any new coins mined coming at a gradually decreasing rate over time. This finite supply creates scarcity, making each unit of the cryptocurrency more valuable as demand increases.

Supply shock events occur for many reasons. A common one would be the Bitcoin halving. The halving means the block reward for miners is reduced by half, leading to a sudden reduction in the rate of new coins produced. This supply reduction often results in increased buying pressure and upward price movements.

Regulatory issues can also lead to supply shock events. For example, if mining is banned in a certain country or if assets are frozen on an exchange.

Importance of supply dynamics in cryptocurrency markets

Supply dynamics are very important in cryptocurrency markets. It is probably the number one driver of price movements. Traditional fiat currencies can be printed at the whim of a central bank. There are no supply constraints. More money can be pumped into the system at any time as we have seen only recently during Covid where the US Dollar doubled the supply overnight. This has led to inflation which wreaks havoc on the poorer classes of society.

Overview of how these events can affect cryptocurrency prices

We have already discussed events that can have an effect on cryptocurrency supply like the Bitcoin halving. On the other hand events that increase the supply such as minting of tokens or the unlocking of restricted tokens can dilute the supply. This could have a negative supply shock on the price of the cryptocurrency.

Definition of supply shock and factors that cause it along with examples from historical occurrences

Supply shock refers to a sudden and significant disruption in the supply of an asset. It can lead to changes in availability and price. When it comes to cryptocurrencies this normally occurs when the supply of coins on the market becomes less and less.

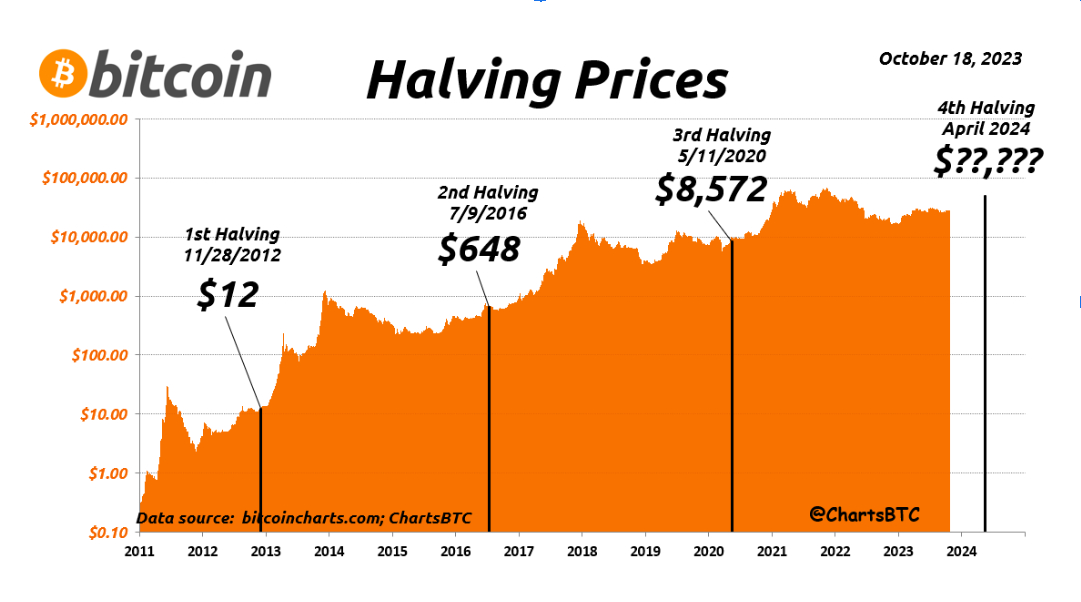

Historical examples include Bitcoin's halving events in 2012, 2016, and 2020. These led to price rallies as the reduction in new supply meant miner's rewards dropped and also investors' demand grew because of scarcity.

Reference:

Bitcoin charts to explore:

Courtesy of @ChartsBTC on Twitter, this logarithmic chart shows Bitcoin’s price against halvings.

Ethereum's Ethereum Improvement Proposal (EIP) 1559 introduced in 2021, brought with it a deflationary mechanism by burning some fees, resulting in a supply shock that contributed to the appreciation of Ether's price.

References:

It's hard to pinpoint the supply effect on ETH as it coincided with a major bull run. People can draw their conclusions.

Decred and Supply Shock:

Decred fixed supply, move to PoS. History of limited supply with staking and where we are now

Decred supply is fixed at 21 million coins. From the latest figures I have (19/03/2024)

- Total coin supply currently is 15,931,541 DCR

- Total staked is 9,848,611 DCR

- Treasury holds 871,692 DCR

- Estimated lost coins or unmoved from dormant/inactive accounts has been roughly estimated at 1 million. We cannot say for sure though.

Decred's latest chart seen above(22/03/2024)

This could mean Decred is one of the scarcest cryptocurrencies on the market with maybe 3 million circulating supply.

Decred moved from PoW to mainly PoS because it was becoming apparent that the miners were mining DCR and then appeared to be selling off the coins mined. They did not show an active interest in holding DCR and were most likely just profiting.

Now with mainly PoS stakeholders can stake their coins in the form of a ticket(Ticket cost varies but as of today the price is 234 DCR). Now instead of the miners earning the reward, the stakeholders will earn the reward. The stakeholders will also have active participation in the community and are unlikely to sell their rewards so freely on the open market.

As more coins are staked, the available supply for trading diminishes, potentially leading to increased scarcity and upward price pressure.

What happens in markets when these supply events occur:

Below are reactions observed in markets during supply events:

- Increase in Scarcity: Heightened scarcity can create panic or FOMO among investors, driving up demand and possibly leading to price appreciation.

- Volatile Price Movements: As we have seen with Decred, and you only need to look at the chart, spikes in price appear quite often. This could happen due to a restriction on supply due to the amount staked or if one of the main exchanges like Binance suddenly runs low on DCR in their wallets.

- Speculation: Investors might monitor supply like any market and see an opportunity to make a profit. They most likely would have algorithmic trading bots constantly looking out for such scenarios.

- Shifts in Market Sentiment: Investors can get nervous when for example a token might release more tokens to the market. They can also get FOMO and in a scarcity situation look to buy, this was ever apparent in the GameStop craze in 2021.

- Long-Term Price Trends: Positive supply shock events like the Bitcoin halving have historically been associated with price appreciation over time. Negative supply shock events may lead to prolonged periods of price stagnation or decline if investor confidence is eroded.

Strategies to deploy during these events:

During supply shock events investors may consider deploying different strategies as listed below:

Hodling: I'm sure everyone is familiar with this term now. Holding for the long term might be the layman's term. Hodlers look for price appreciation over the long term, driven by increased scarcity and growing demand.

Dollar-Cost Averaging (DCA): This strategy involves buying regular amounts of cryptocurrency at set intervals, maybe once a month. This limits risk and also means you may get a decent average price over the long term as the asset grows in value.

Staking: Investors who believe in a project or cryptocurrency can avail of staking in some cases. This allows them to earn rewards by staking and assisting the protocol. Over the long run these rewards will compound and if the price appreciates the investors will benefit.

Trading Volatility: Short-term traders can benefit in supply shock scenarios by possibly predicting the event and buying low and selling high. More and more trading bots are being deployed that can run algorithms and see events occurring and benefit from the price movements.

Managing The Risk: As always investors need to manage their risk and never leave themselves in a position for a huge loss. Being sensible and controlling emotions is key.

Identifying Market Trends: Staying informed and looking out for trends, the latest news, and technical indicators can help investors pounce upon opportunities

By carefully considering all these factors investors can position themselves to capitalize on opportunities.

Potential future supply shock scenarios:

When anticipating potential future supply shock scenarios on could look out for the following:

- Upgrades to Protocols: How will these affect the supply? Is there an opportunity to take advantage?

- Changes in Laws: For example, Binance delisted Monero recently. They announced this information publicly causing a slide in the XMR price. It appears people took an opportunity to buy Monero then because the underlying protocol hadn't changed and fundamentals remained the same.

Technological Innovations: Advances in blockchain technology or the development of new consensus mechanisms could alter the supply dynamics of cryptocurrencies. For example, the introduction of more efficient mining algorithms or the implementation of layer 2 scaling solutions could impact the rate at which new tokens are created.

Halving Events: For cryptocurrencies with fixed issuance schedules like Bitcoin, future halving events could continue to cause supply shock events. As the block reward decreases over time, the rate at which new coins are generated diminishes, potentially leading to increased scarcity and upward price pressure.

Token Burns: Some projects may decide to burn tokens which will reduce the supply. This should make the price appreciate as the tokens are now more scarce.

Economic Events: External economic events, such as hyperinflation or financial crises, could impact the supply dynamics of cryptocurrencies.

Shifts in Mining Behavior: As we have seen with Decred as the mining reward was reduced, more miners decided to sell their coins. In the long term though when the selling stops then the project should benefit as less selling pressure is exerted.

Governance Decisions: Decred and other projects have built-in Governance. For example, a vote on spending from the treasury could have a big impact on Decred if a proposal passes for a large amount of DCR coins to be spent.

Conclusion:

In conclusion, supply shock events are capable of exerting significant influence on prices, investor sentiment, and market dynamics. Education is key in this area to seize opportunities and notice the projects that put stakeholders first. Factors like protocol upgrades, regulatory changes, technological innovations, or economic events can all affect supply or cause a supply shock.

Comments ()