Looking at the crypto news from March.

Coinbase Outage

Coinbase users worldwide faced another issue with $0 crypto balances as Bitcoin reached over $67,000 for the first time in more than two years.

This marked the second outage for Coinbase in less than a week, coinciding with Bitcoin hitting a 28-month high on March 4. The crypto fear and greed index indicated strong interest, reaching 82.

Despite CEO Brian Armstrong stating preparedness for increased traffic after the first outage on February 28, the surge in Bitcoin activity surpassed expectations, causing another interruption.

Although Coinbase assured users of fund safety and ongoing efforts to restore normal operations, the incident raised concerns about the exchange's readiness for heavy traffic during a bullish market cycle, as users expressed dissatisfaction with the disruption.

We appreciate your patience. We're beginning to see improvements in latencies and completed transfers. Rest assured your funds are safe. https://t.co/l12ErSL22k

— Coinbase Support (@CoinbaseSupport) March 4, 2024

Monero Attack

It has not spread to the mainstream news but it appears Monero has been subject to a flooding attack.

There are lots of theories floating about at the moment. From an interesting thread on Reddit we can see some of the possible causes but yet to have a definitive answer.

Let's explore exactly what a flooding attack is and then discuss possible reasons.

A flooding attack refers to a malicious attempt to disrupt the network by overwhelming it with a large volume of transactions or data. Unlike traditional network flooding attacks that target centralized systems, flooding attacks on blockchains aim to exploit the decentralized nature of the network to disrupt its normal operation.

Flooding attacks of blockchains can take many different shapes:

- Transaction Flooding: This can occur when the attacker sends a large number of legitimate-looking transactions to the blockchain network. These transactions may be designed to consume excessive amounts of network bandwidth, storage space, or processing power, leading to congestion and delays in transaction processing. Transaction flooding attacks can result in increased transaction fees for legitimate users and slow down the overall network throughput.

- Data Flooding: In a data flooding attack, the attacker floods the blockchain network with large volumes of data, such as spam transactions, invalid blocks, or malicious smart contracts. This flood of data can overwhelm the network nodes, consuming their computational resources and storage capacity. Data flooding attacks can disrupt the normal operation of the blockchain network, leading to delays in transaction processing and potentially causing nodes to crash or become unresponsive.

- Sybil Attacks: Sybil attacks involve creating multiple fake identities or nodes to flood the network with fake transactions or data. By controlling a large number of nodes, the attacker can manipulate the blockchain consensus mechanism, disrupt the network, or launch other types of attacks, such as double-spending or eclipse attacks.

These attacks can have serious consequences. Network congestion, increased transaction fees, and reduced network reliability are some of those consequences.

To mitigate flooding attacks, blockchain networks often implement measures such as transaction throttling, fee estimation algorithms, consensus rules, and network monitoring tools. Additionally, community vigilance, timely software updates, and consensus mechanism improvements can help strengthen the resilience of blockchain networks against flooding attacks.

Possible reasons and theories are explored on the Monero Reddit community:

Theories and discussions about the ongoing 'attack'

by u/vapor-ware in Monero

Another theory is that of the Monero Black Marble Flood:

There is a thread on Twitter explaining in detail what was suspected -

Monero prides itself on privacy. But what happens when this privacy is threatened?

— Schmidt (@schmidt1024) March 29, 2024

Enter the Black Marble Theory - a potential Achilles' heel for the network.

🧵1/6 👇🏻

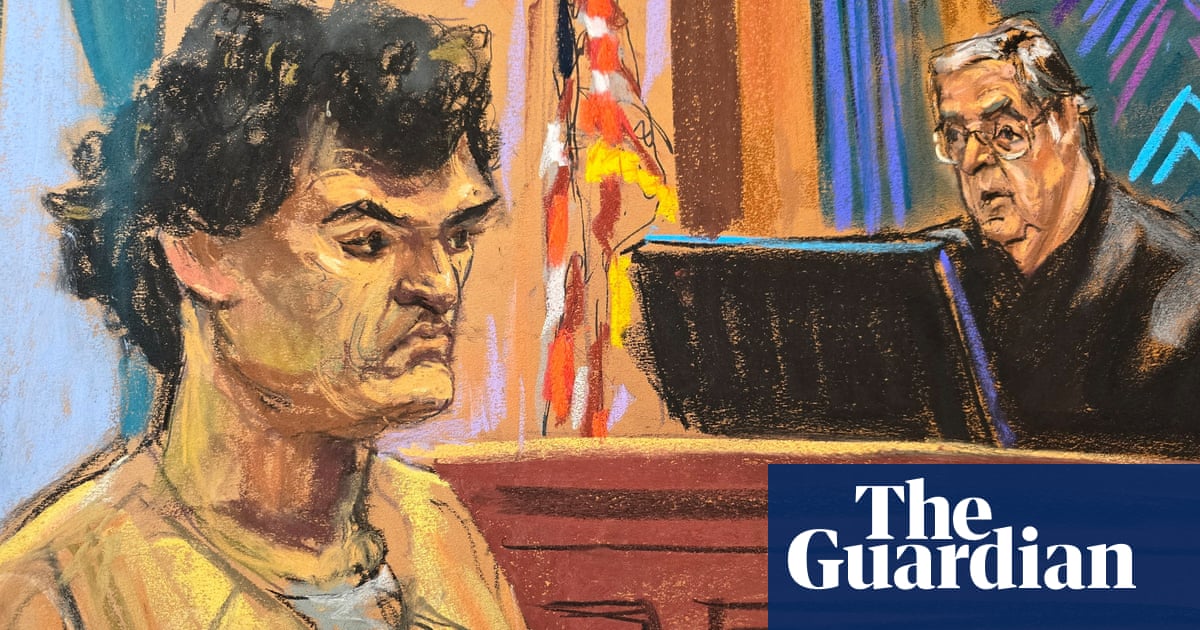

SBF Jailed

Sam Bankman-Fried sentenced to 25 years in prison over FTX fraud.

Most people are aware and have been following this story. The judge decided however in the end that SBF was a calculating math genius who sought power and influence while knowingly committing wrongdoing. With a series of bad decisions there was never any remorse shown and a 25-year sentence was handed down.

A great article by The Guardian goes into the details behind the case:

March roundup

March 1st to March 10th:

- Hong Kong draws 22 firms seeking crypto exchange licenses including OKX, Bybit and HTX

- Nigerian government demands $10 billion in damages from Binance

- MicroStrategy announces proposed private offering of $600 million of convertible Senior Notes, intends to use proceeds in part to buy additional Bitcoin

- Deutsche Boerse launches regulated spot platform for crypto assets

- Coinbase has been increasingly dominant in the U.S. since the ETF approvals. Over the past 3 months, its BTC market share has climbed from 47% to 60%

The CypherPunk Times weekly roundup thread of what happened Mar 1st - Mar 10th#CryptocurrencyNews pic.twitter.com/3lG2VakXTh

— cypherpunktimes (@cypherpunktimes) March 10, 2024

March 11th to March 18th:

- EU Parliament approves new sanctions laws that also apply to crypto

- BlackRock's BTC ETF has surpassed 200,000 BTC under management

- Thailand greenlights income tax exemption for investment token earnings: report

- Craig Wright, not Satoshi, didn't author Bitcoin whitepaper, judge rules

- El Salvador has thousands more Bitcoins than previously known, has moved over 5,000 BTC into a cold wallet

- Bitcoin tops Taylor Swift, and Beyoncé in Google Search US results

The CypherPunk Times weekly roundup thread of what happened Mar 11th - Mar 17th#CryptocurrencyNews pic.twitter.com/AQDQUTxcSh

— cypherpunktimes (@cypherpunktimes) March 17, 2024

March 19th to March 26th:

- Binance's user asset holdings exceed $100 billion

- Southeast Asia super-app Grab offers crypto payment options in Singapore

- World's largest pension fund seeks information on Bitcoin under the portfolio diversification plan

- MicroStrategy has acquired an additional 9,245 BTC for ~$623.0M using proceeds from convertible notes & excess cash for ~$67,382 per Bitcoin

- BlackRock to launch a tokenized investment fund with Securitize

- Ethereum Foundation has received a confidential inquiry from a state authority, showing GitHub commit

- Over the past decade, BTC and Gold have shown little correlation, which could suggest that the drivers of gold demand have been different from Bitcoin’s

The CypherPunk Times weekly roundup thread of what happened Mar 18th - Mar 25th#CryptocurrencyNews pic.twitter.com/MPZosyslXD

— cypherpunktimes (@cypherpunktimes) March 24, 2024

March 27th to March 31st:

- Binance's successor in Russia, CommEx, halting deposits and undergoing phased closure

- London Stock Exchange decided to launch market in crypto ETNs on 28 May 2024

- Bitcoin volatile price activity has been more concentrated during U.S. opening hours

- HSBC launches retail tokenized gold products in Hong Kong

- Memecoin 'finfluencers' are falling under the UK's Financial Conduct Authority's regulatory spotlight

- SBF SENTENCED TO 25 YEARS IN PRISON

The CypherPunk Times weekly roundup thread of what happened Mar 26th - Mar 31st#CryptocurrencyNews pic.twitter.com/4DKi0zODwN

— cypherpunktimes (@cypherpunktimes) April 1, 2024

Comments ()